It’s been 10 years since I made that decision, venturing out into the unknown with the full weight of being both Dad and Mom to my four very young children on my shoulders. Was it easy? Did the load lighten up over the years? The journey consists of many travels through hell and back. The challenges were always, and are still, present. They just shift weight and come in different varieties. My greatest gift, though, is the fact that I was given that privilege to be both parents to my children. The pain from the betrayal, the fear of the uncertainties, the struggles whilst ensuring that we have food on the table, the loneliness upon realizing that the closest people who should have been there to support me were the ones blaming me for the failed marriage; all these were blessings that made me who I am today. This inspired me to share my blessings and the lessons I have picked up along the way with the public. Enjoy the series of blogs entitled Lessons from a Single Momma.

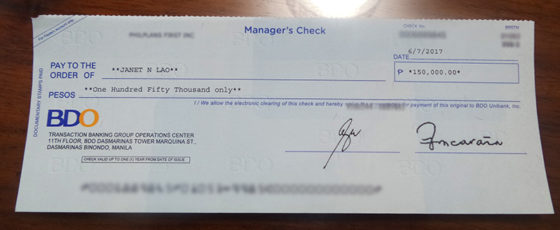

We have already set up the educational plans for the 3 older kids and have been paying for a few years when we found out that we were pregnant with our 4th. Our family was growing fast as we got busier with the business. That same year that our youngest bundle of joy joined us, the business was in another stage of expansion and we moved our family into a bigger home inside an exclusive subdivision in Quezon City. Life was bliss. Our new neighbor, who eventually became our good friend, introduced us to another pre-need company and its educational plans. Since I was never a believer of this type of investment and never took interest in learning about its benefits, it was my husband who decided to take one out for our 2 year old *bunso and to use my name instead of his. All paid up and long forgotten, it was early this year that I received a text message from the company’s head office informing me of the maturity benefits and the option of pulling it out. I was surprised at this unexpected good news. After reviewing the plan and signing all the papers, I received the first of the five checks of the maturity benefits. Today, my bunso is a 15 year old 9th grader. That first check, and the remaining checks that will be released in the next four years, will pay for her tuition fees until she reaches her first year in the university.

I am overwhelmed with great gratitude for that part of my past that I agreed to start the plans for my children. I never thought there would come a day that the money will be needed. That day did come. And the money is here. In less than 2 months, I am entering my 9th year as a professional financial planner. All the more I appreciate the service that I do for my clients and the value that I deliver to their family and business.

The future is not for us to guarantee. That is why we plan for it based on our present capability. Having a plan/policy today is better than not having a plan/policy at all. Let me help you get started with one and walk with you as you continue to build your personal financial plan.

linkiNG you to opportunities,

*bunso– (Filipino term of reference) the youngest child